NI today hit the 61.8 fibonacci line which is 2.75. It may have a slight correction since it was not able to close above the kijun-sen line / 50% fibonacci line. Last candlestick looks bearish but the RSI is 51 which has more room to go.

Conclusion: Hmmm... that depends on you ^_^

Monday, March 31, 2014

Stock in Focus: ABOITIZ EQUITY VENTURES (AEV)

AB Capital's Opinion

We maintain our SELL rating on AEV but upgrade its Target Price to PHP 48.00 (from PHP 47.05) after taking into account our Target Price revisions on subsidiaries Agoutis Power Corp. (AP) and Union Bank of the Philippines (UBP). We forecast a 15% decline in profits in 2014 driven by lower net income from AP and UBP which account for 92% of AEV’s core profits.

AEV reported PHP 21.0billion in core Net Income, 10% lower year-on-year but higher than our forecast of PHP 20 billion, driven by Pimlico and Agoutis Land's higher contributions. Revenues, on the other hand, grew by 12% to PHP 91.0 billion in 2013. EBITDA (excluding assoc. earnings) was at PHP 26.7 billion in 2013, 3% lower compared to PHP 27.5 billion in 2012.

We upgraded our valuations on subsidiary AP after considering capacity expansions between 2014-2017, which amounts to over 1,320 megawatts in additional capacity. We estimate that this adds PHP 10.00 to our NAV estimate. Profits from AP's power generation segment remained weak, declining by 33% to PHP 15.2 billion in 2013. We continue to see a decline in AP's earnings driven mainly by higher income taxes after the expiration of the income tax holiday on several power assets. We see earnings declining by 15.0% in 2014 and 10.0% in 2015.

Subsidiary UBP, meanwhile, reported Net Income of PHP 9.0 billion in 2013, 19.0% higher compared 2012 and in line with our forecast. We expect UBP to post an earnings decline of 7.0% in 2014 to PHP 8.4 billion, as interest-yielding assets and fee-based services shoulder the reduced contribution of trading gains. Similar to other banks, UBP will have to grow its loan portfolio to offset the effects of higher interest rates.

Pilmico reported a 3.0% decline in Net Profits to PHP 1.26 billion in 2013. Stronger profits from farms and flour segments were offset by the profit decline from the feeds business. Higher input costs and lower average selling prices underpinned the 19.0% decline in booked profits from the feeds division. Feeds account for 42.0% of total Net Income. We expect Pilmico's net profits to be flat this year driven by marginal increases in selling prices and sales volume.

We see AEV's Net Income to decline by 12.0% to PHP 18.4 billion in 2014 and stay flat in 2015. We think lower profits from AP and UBP will weigh down consolidated profits as these account for 92.0% of our projected profits.

RECOMMENDATION: We upgrade AEV's Target Price to PHP 48.00, but maintain our SELL rating, after taking into account our revised Target Prices for AP (PHP 43.00) and UBP (PHP 136.90).

AEV's 2014 P/E is at 17x vs. 14x regional peer average with an EPS growth of 49.0% on average. AEV also has no discount to our NAV at the current price compared to an average conglomerate discount of 27% in our entire stock coverage.

-PinoyInvestor

We maintain our SELL rating on AEV but upgrade its Target Price to PHP 48.00 (from PHP 47.05) after taking into account our Target Price revisions on subsidiaries Agoutis Power Corp. (AP) and Union Bank of the Philippines (UBP). We forecast a 15% decline in profits in 2014 driven by lower net income from AP and UBP which account for 92% of AEV’s core profits.

AEV reported PHP 21.0billion in core Net Income, 10% lower year-on-year but higher than our forecast of PHP 20 billion, driven by Pimlico and Agoutis Land's higher contributions. Revenues, on the other hand, grew by 12% to PHP 91.0 billion in 2013. EBITDA (excluding assoc. earnings) was at PHP 26.7 billion in 2013, 3% lower compared to PHP 27.5 billion in 2012.

We upgraded our valuations on subsidiary AP after considering capacity expansions between 2014-2017, which amounts to over 1,320 megawatts in additional capacity. We estimate that this adds PHP 10.00 to our NAV estimate. Profits from AP's power generation segment remained weak, declining by 33% to PHP 15.2 billion in 2013. We continue to see a decline in AP's earnings driven mainly by higher income taxes after the expiration of the income tax holiday on several power assets. We see earnings declining by 15.0% in 2014 and 10.0% in 2015.

Subsidiary UBP, meanwhile, reported Net Income of PHP 9.0 billion in 2013, 19.0% higher compared 2012 and in line with our forecast. We expect UBP to post an earnings decline of 7.0% in 2014 to PHP 8.4 billion, as interest-yielding assets and fee-based services shoulder the reduced contribution of trading gains. Similar to other banks, UBP will have to grow its loan portfolio to offset the effects of higher interest rates.

Pilmico reported a 3.0% decline in Net Profits to PHP 1.26 billion in 2013. Stronger profits from farms and flour segments were offset by the profit decline from the feeds business. Higher input costs and lower average selling prices underpinned the 19.0% decline in booked profits from the feeds division. Feeds account for 42.0% of total Net Income. We expect Pilmico's net profits to be flat this year driven by marginal increases in selling prices and sales volume.

We see AEV's Net Income to decline by 12.0% to PHP 18.4 billion in 2014 and stay flat in 2015. We think lower profits from AP and UBP will weigh down consolidated profits as these account for 92.0% of our projected profits.

RECOMMENDATION: We upgrade AEV's Target Price to PHP 48.00, but maintain our SELL rating, after taking into account our revised Target Prices for AP (PHP 43.00) and UBP (PHP 136.90).

AEV's 2014 P/E is at 17x vs. 14x regional peer average with an EPS growth of 49.0% on average. AEV also has no discount to our NAV at the current price compared to an average conglomerate discount of 27% in our entire stock coverage.

-PinoyInvestor

Market Review 3-31-2014

Banks: BDO credit rating raised to investment grade.

BDO Unibank Inc’s (BDO – BUY) baseline credit assessment by Moody’s was raised one notch to investment grade (baa3). Moody’s cites BDO’s improved asset quality, robust liquidity and capital, and ability to withstand a cyclical downturn as among the reasons for the upgrade. This takes BDO at par with the ratings of Bank of the Philippine Islands and Metrobank.

Economy: Automatic fare collection PPP to be signed today.

The concession agreement for the automatic fare collection system (AFCS) which involves the construction of a unified ticketing system for the LRT and MRT shall be finalized and signed today. The AFCS project worth PHP1.7b will be awarded to the consortium which includes Ayala Corp (AC – BUY) and Metro Pacific Investments Corp (MPI – Under review).

-Maybank ATR

BDO Unibank Inc’s (BDO – BUY) baseline credit assessment by Moody’s was raised one notch to investment grade (baa3). Moody’s cites BDO’s improved asset quality, robust liquidity and capital, and ability to withstand a cyclical downturn as among the reasons for the upgrade. This takes BDO at par with the ratings of Bank of the Philippine Islands and Metrobank.

Economy: Automatic fare collection PPP to be signed today.

The concession agreement for the automatic fare collection system (AFCS) which involves the construction of a unified ticketing system for the LRT and MRT shall be finalized and signed today. The AFCS project worth PHP1.7b will be awarded to the consortium which includes Ayala Corp (AC – BUY) and Metro Pacific Investments Corp (MPI – Under review).

-Maybank ATR

Saturday, March 29, 2014

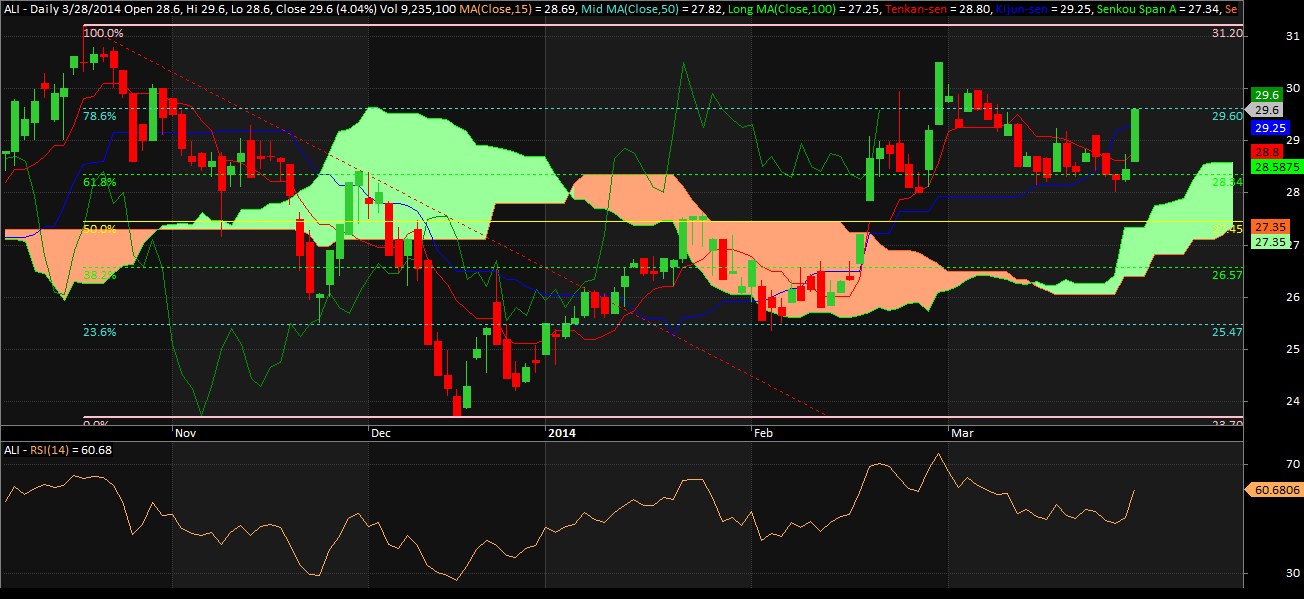

ALI touched 29.60

ALI closed at exactly 29.60 with 4.04% day change. Last candlestick is White Marubozu which is considered very bullish because it indicates that the buyers are in control of the price from the opening bell to the close of the day.

On the chart below, next resistance is at 30.50 then 31.20.

RSI is now 60.68 which is near overbought.

On the chart below, next resistance is at 30.50 then 31.20.

RSI is now 60.68 which is near overbought.

78.6% Fibonacci Line supporting BHI

On the daily chart below, the 78.6% fibonacci line supports BHI's price last price. This has been a strong support since it has been tested many times in the past. Does it mean that it is the time for this stock to rise again?

Last candlestick is a doji. It's telling that there is an indecision on the price. And since its a downtrend, a reversal may be possible. We'll need a confirmation for that on the next trading day.

Market Talk (March 28, 2014)

Economy: Policy move yesterday unlikely to be followed soon.

Despite the increase in reserve requirement and the reduction in financial liquidity by about PHP57b, money supply growth will remain flush. Indeed, by the central bank’s own estimates, growth will likely slow to 15-17% from over 30% in recent months. As a result, we maintain that any knee-kerk spike in interest rates will eventually be smoothed downward, especially since the inflation outlook remains benign. We continue to expect a 50-bp rise in policy rates in the next 26 months (that is, to the end of 2015), in well spaced-out 25-bp increments.

Banks: MBT declares PHP1/sh cash dividend. Metrobank (MBT – HOLD) declared cash dividends of PHP1/sh, in line with our forecasts. At the current price this translates to a dividend yield of 1.3%. Record and payment dates have yet to be set following approval from the central bank.

Energy: PCOR raises PHP5.4b as retirement fund sells shares.

Petron Corp (PCOR – BUY) disclosed the Petron Corp Employees’ Retirement Plan (PCERP) sold 470m common shares of PCOR at PHP11.50/sh amounting to PHP5.4b via private placement last 26 Mar. Settlement is on 1 April. Proceeds will be used to partially pay PCERP’s advances from PCOR totaling PHP16.2b as of 9M13. The shares sold represent around 34% of PCERP’s total holdings in PCOR. Prior to the transaction, PCERP owned 14.79% or around 13.9b common shares of PCOR. Post-sale, PCOR’s free-float is now nearly 22%, while PCERP still owns 9.8% of PCOR’s common shares.

-Maybank ATR

Despite the increase in reserve requirement and the reduction in financial liquidity by about PHP57b, money supply growth will remain flush. Indeed, by the central bank’s own estimates, growth will likely slow to 15-17% from over 30% in recent months. As a result, we maintain that any knee-kerk spike in interest rates will eventually be smoothed downward, especially since the inflation outlook remains benign. We continue to expect a 50-bp rise in policy rates in the next 26 months (that is, to the end of 2015), in well spaced-out 25-bp increments.

Banks: MBT declares PHP1/sh cash dividend. Metrobank (MBT – HOLD) declared cash dividends of PHP1/sh, in line with our forecasts. At the current price this translates to a dividend yield of 1.3%. Record and payment dates have yet to be set following approval from the central bank.

Energy: PCOR raises PHP5.4b as retirement fund sells shares.

Petron Corp (PCOR – BUY) disclosed the Petron Corp Employees’ Retirement Plan (PCERP) sold 470m common shares of PCOR at PHP11.50/sh amounting to PHP5.4b via private placement last 26 Mar. Settlement is on 1 April. Proceeds will be used to partially pay PCERP’s advances from PCOR totaling PHP16.2b as of 9M13. The shares sold represent around 34% of PCERP’s total holdings in PCOR. Prior to the transaction, PCERP owned 14.79% or around 13.9b common shares of PCOR. Post-sale, PCOR’s free-float is now nearly 22%, while PCERP still owns 9.8% of PCOR’s common shares.

-Maybank ATR

Friday, March 28, 2014

Market Talk: MER

Utilities: MER petitions payment of excess January charges over six months. As reported by various news agencies, Manila Electric Co (MER – HOLD) petitioned the Energy Regulatory Commission (ERC) for the recovery of its deferred generation costs for the billing month of January amounting to PHP0.45/kWh. The petition further asks the payment to be made in PHP0.0751/kWh installments over six months. However, MER also said that “all-in” costs can reach PHP0.11/kWh per month when other deferred bill component charges are considered. The revised January rates reflect the adjustments in generation charges to PHP6.12/kWh following an ERC order to recalculate the Wholesale Electricity Spot Market (WESM) rates for November and December after finding these to be unreasonable, irrational and competitive. MER did not use the original generation charge of PHP10.23/kWh for its January billing, but instead maintained the November rate of PHP5.67/kWh rate, which is PHP0.45/kWh lower than revised rate of PHP6.12/kWh.

-Maybank ATR

-Maybank ATR

Market Talk: ALI

Property: ALI announces PHP township project in Bulacan.

Ayala Land Inc. (ALI-BUY) announced that it will be investing almost PHP7b for a township project in the largest city in Bulacan province north of Metro Manila within the next five years. This is the 98-hectare Altaraza, the first master-planned township project in San Jose Del Monte which forms part of ALI’s efforts to seize expansion opportunities in the north and outside Metro Manila. Altaraza is a 50-50 joint venture with Araza Resources Corp. Of the 98 hectares, 12 hectares were set aside by ALI for its residential project Avida. The project is not included in our land bank and our NAV estimate. It would add up to PHP0.25 to our current NAV to bring it to PHP42.25/sh.

-Maybank ATR

Ayala Land Inc. (ALI-BUY) announced that it will be investing almost PHP7b for a township project in the largest city in Bulacan province north of Metro Manila within the next five years. This is the 98-hectare Altaraza, the first master-planned township project in San Jose Del Monte which forms part of ALI’s efforts to seize expansion opportunities in the north and outside Metro Manila. Altaraza is a 50-50 joint venture with Araza Resources Corp. Of the 98 hectares, 12 hectares were set aside by ALI for its residential project Avida. The project is not included in our land bank and our NAV estimate. It would add up to PHP0.25 to our current NAV to bring it to PHP42.25/sh.

-Maybank ATR

Market Talk: PGOLD

Consumer: PGOLD posts 46% earnings growth to PHP3.96b in 2013.

Puregold Price Club Inc (PGOLD – BUY) announced 2013 audited net income of PHP3.96b, up 46% and slightly ahead of our PHP3.7b estimate and PHP3.8b consensus. Implied 4Q13 earnings of PHP1.3b were higher 44%. 2013 net sales increased 27% to PHP73.2b, in line with our forecast. This implies 4Q13 topline growth of 18%, slightly improving from 3Q13's 16.5%.Higher revenues were driven by the opening of 40 new Puregold stores and two S&R stores during the year and acquisition of 15 Company E stores in 1Q13, bringing PGOLD’s total store network to 213 as of end-2013. 2013 gross profit margin improved 1.3pps to 17.4%, tracking our expectation. Net margin meanwhile increased 0.7pps to 5.4%, higher than initial indication and our estimate of 5.1%. We will be issuing a more detailed report but for now maintain our BUY rating.

-Maybank ATR

Thursday, March 27, 2014

Stock Recomendations

Stock Code Target Price

Banks

- PNB 111

- RCB 60

Consumer

- PF 310

- DMPL 30

Property

- ALI 37.8

- FLI 2.20

Utilities

- PNX 7.22

- TA 2.80

Conglomerates

- AC 769

- LPZ 8.78

-Maybank ATR

EMP on support?

EMP got support from the 50% fibonacci line at 11.48. Does it mean to bounce on the next day? We need a confirmation for that.

Tuesday, March 25, 2014

LRW may go beyond 1.60

LRW rallied with 24.5% increase from the last day. It was done consolidating and established a support from 0.92. Immediate resistance will be at 1.31 and support at 1.08. With RSI at 76 which is overbought, a pullback may happen.

But if the resistance will be broken, then we can expect at 1.60 as our next stop.

But if the resistance will be broken, then we can expect at 1.60 as our next stop.

Monday, March 24, 2014

MARC on resistance at 4.22

Today MARC hit the resistance at exactly 4.22 with a bearish candlestick. This means that it has a higher probability to reverse on the next day. Observe the RSI is currently 77 which is overbought. If MARC will reverse, the immediate support will be 3.86. Even though MARC has a bearish candlestick, overall trend is still "green".

Saturday, March 22, 2014

RWM looking for support

RWM drops -10.2% based on the weekly chart. This is due to the news that its income from 2013 drops 60%. Tsk3x.

On the daily chart below, the next support is at 8.85. Let's see if this support will hold or not. The current price is a new low so we don't have a strong support for now.

RSI is approaching the oversold level.

Based on the chart below, it doesn't look good.

UPDATE 3-24-2014:

Since the 8.85 didn't hold, next support will be 8.45.

On the daily chart below, the next support is at 8.85. Let's see if this support will hold or not. The current price is a new low so we don't have a strong support for now.

RSI is approaching the oversold level.

Based on the chart below, it doesn't look good.

UPDATE 3-24-2014:

Since the 8.85 didn't hold, next support will be 8.45.

Shooting star on BKD

BKD closed last friday with a shooting star (a reversal pattern) which coincides with the RSI at 74 which is overbought. If reversal will be confirmed next week, then the immediate support is 2.17 and resistance is 2.25.

Thursday, March 20, 2014

BDO having hard time breaking the 85.23 resistance

Based on the daily chart below, BDO still can't break the resistance at 85.23. RSI is near overbought and stock's price may reverse down to 81.97. But if the resistance will be broken, it can go up to 90.41. Still, all ichimoku indicators are on green signal.

Sign of the cross on AEV

AEV rallied 3 days straight proving that the bulls are going wild. But today, it closed with a doji candlestick telling us that there is an undecision on the stock's price. Will the bulls win to continue it's uptrend or the bears will slaughter the bulls because its their time to reverse the stock' price? We'll need a confirmation tomorrow.

RSI value is 62 which is near the overbought level but still got some room to go up.

Current resistance range are 61.5 to 61.6

Immediate supports are 59.42 down to 58.87

Next support range are 57.8 to 57.19

RSI value is 62 which is near the overbought level but still got some room to go up.

Current resistance range are 61.5 to 61.6

Immediate supports are 59.42 down to 58.87

Next support range are 57.8 to 57.19

Will AC bounce tomorrow?

AC closed today with -0.4% from the previous day.If you observe on the daily chart below, you will see that its lowest price touched the kijun line. Will it bounce because of that?

Immediate resistance at 565

Another resistance at 571 but not strong (I guess)

Immediate support at 560 in which this stock closes above it.

Next support is 556.

RSI is still good at 51

Recommendation? It's up to you. It's you money. :)

Immediate resistance at 565

Another resistance at 571 but not strong (I guess)

Immediate support at 560 in which this stock closes above it.

Next support is 556.

RSI is still good at 51

Recommendation? It's up to you. It's you money. :)

Sunday, March 9, 2014

TA touching the 50% fibo line

On our weekly chart below, you can see that TA touched the 2.18 resistance on the 50% fibo line. Observe also that the Bolinger band is near that price which also acts as a resistance. Looking at the RSI at 58, we can conclude that it can go 2.38 to 2.65 because it's still far from overbought. The immediate support is at 1.99 (38.2% of fibo line) down to 1.88 (Base line of Ichimoku).

TEL currently on resistance

TEL touched the 50% fibo line at 2,826 which acts as a resistance. If you observe the last candlestick, it shows a bearish sign. TEL has been very strong last week because of its upcoming dividend this March 13, 2014 which will give the stockholders a total of 116 pesos. Whoa that's big!

The question is will the 'dividend play' breaks the resistance at 50% fibo line or will it retrace because of resistance?

With RSI currently at 68 near overbought, it may retrace to 2,766 which acts as the immediate support and can go up to 3,080 which is the 100% of the fibo line.

Last Friday, TEL is still on NFB (Net Foreign Buy).

The question is will the 'dividend play' breaks the resistance at 50% fibo line or will it retrace because of resistance?

With RSI currently at 68 near overbought, it may retrace to 2,766 which acts as the immediate support and can go up to 3,080 which is the 100% of the fibo line.

Last Friday, TEL is still on NFB (Net Foreign Buy).

Tuesday, March 4, 2014

Matching low candlesticks on ORE

Based on the daily chart below, you can see that ORE is starting to regain itself from its lowest price last Feb 27, 2014 which is 1.59. You will see a matching low candlesticks which is a sign of reversal for this stock. If you observed on RSI, its value is 51 which will have more room to go before overbought.

Current support at 1.56 to 1.52 if it will not reverse. Immediate resistance at 1.66.

Good luck!

Current support at 1.56 to 1.52 if it will not reverse. Immediate resistance at 1.66.

Good luck!

Sunday, March 2, 2014

Sign of life for NXT?

NXT closed last friday with a solid small green that bounced from the lower part of Bolinger band. Does it mean that this stock will reverse? Based on the daily chart below, it has an immediate resistance at 2.50 where a lot of activity happened in this area. Also in the RSI below, you can see that it has bounced also and the current value is at 40 which is far from overbought.

Good luck.

Good luck.

ROX to encounter spike this week?

Based on the daily chart last week, ROX closed with a doji candlestick and got support from the blue line (6.18). Remember that this stock has a resistance at 6.27 as you can see on the 23.6% fibo line of the daily chart below. If a reversal will be confirmed tomorrow we got a bigger chance to break that resistance and may hit 7.50.

Good luck!

Good luck!

Subscribe to:

Comments (Atom)